撰文:Lawrence,火星财经

今天我们要聊的,是日本前顶流女教师三上悠亚老师带着她的「Mikami 币」杀入加密货币市场的魔幻现实。听说这项目白皮书里写着要把粉丝经济、AI 代理、DAO 治理和神社信仰打包塞进区块链,我当场连炫了三碗螺蛳粉才压住震惊——这不就是当代互联网的「量子叠加态骗局」吗?

一、从写真 NFT 到发币:顶级流量的财富密码迭代史

三上老师进军 Web3 的履历堪称加密韭菜培养教科书。早在 2021 年,她就以 28 张「艺术写真 NFT」创下 17 万人民币单张成交记录,彼时正值 NFT 泡沫巅峰期,韭菜们用真金白银验证了「LSP 经济学」的终极奥义:只要硬盘里存着老师的作品,钱包里就敢给数字证书打钱。

到了 2025 年 2 月,她闪现香港兰桂坊酒吧参加交易所活动时,业内老狗们已经嗅到了妖风。果然两个月后,Solana 链上就冒出个代币分配表比《让子弹飞》分赃计划还刺激的 Mikami 币——50% 锁仓到 2069 年(相当于把私钥刻在秦始皇陵兵马俑脸上)、20% 预售让「大哥」们先跑、5% 营销预算怕不是要给暗网资源站投广告。

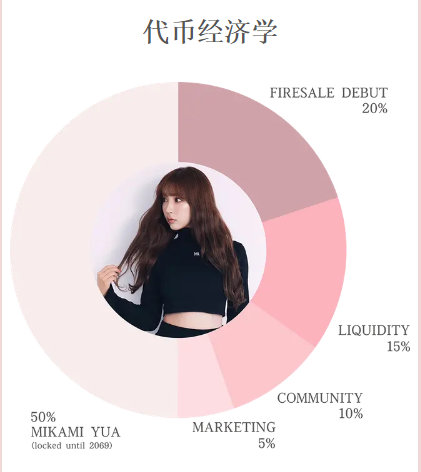

二、代币分配:一场精心设计的「饥饿游戏」

让我们用手术刀剖开白皮书的「黄金分割」:

-

50% 锁仓至 2069 年:这招堪称「区块链版望梅止渴」,等解锁时三上老师都 76 岁了,届时元宇宙里跳广场舞的虚拟大妈可能比持币人多

-

20% 预售份额:明摆着让「加密秃鹫」们先吃饱,参考此前某动物币庄家凌晨 3 点拉盘、5 点跑路的经典操作

-

15% 流动性池:按当前 SOL 价格估算,开盘市值约等于三上老师三年工资(1000 万人民币),但考虑到 Meme 币平均换手率 2000%,足够庄家玩十轮「俄罗斯轮盘赌」

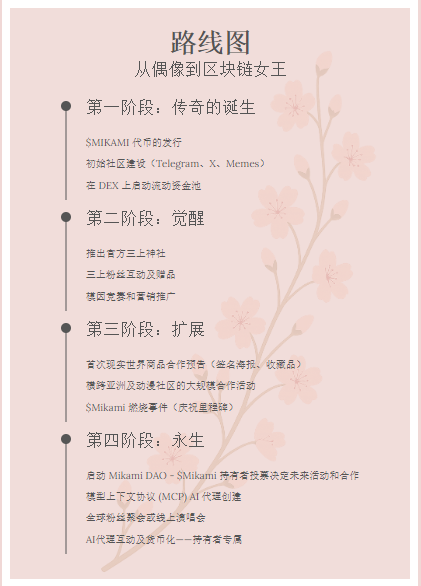

三、路线图剖析:披着 Web3 皮的传统收割术

项目方规划的四大阶段,堪称「区块链缝合怪」的集大成之作:

-

神社经济:把粉丝朝圣行为代币化,参考日本某寺庙发行「功德 NFT」导致和尚炒币破产的魔幻案例

-

AI 代理:声称要打造虚拟三上,但现实是 99% 的 AI 项目都在用 ChatGPT 套壳,效果堪比淘宝 9.9 元定制女友服务

-

DAO 治理:表面让持币人投票,实则预留超级管理员密钥,参考某知名 DAO 项目创始人卷款 4000 万美元后声称「私钥被猫吃了」的荒诞剧

四、粉丝经济与加密庞氏的化学反应

粉丝值 1U 还是 10U?按三上悠亚目前推特 823 万粉丝基数计算,代币市值可能在 823 万到 8230 万美元之间波动。这个估值模型让我想起东莞 ISO 服务定价策略——基础服务、增值服务、至尊 VIP 套餐分层定价。

但别忘了成人产业特有的「沉默粉丝」现象:那些深藏功与名的老司机可能宁愿买十张实体碟,也不愿在链上留下永久交易记录。这导致实际购买力可能只有表面数据的 20%。

-

NFT 购买力陷阱:当年花 17 万买写真的土豪,99% 已被套在数字藏品市场

-

饭圈打榜逻辑失效:女团投票是情感消费,炒币是零和博弈,参考某偶像代币暴跌 90% 后粉丝集体在交易所门口拉横幅行为艺术

-

生命周期错配:女优平均职业周期 5-8 年,而 Meme 币存活期中位数仅 27 天,这波操作相当于用保质期 3 天的酸奶做十年陈酿

五、操盘手的神秘面纱:专业镰刀队的降维打击

从白皮书透露的蛛丝马迹看,背后团队极可能是「暗黑界高盛」:

-

代币经济模型:完美复刻 2024 年某跑路项目的「四段式收割法」,区别只是把二次元头像换成写真

-

跨链部署策略:选择 Solana 而非 ETH,显然是看中其「秒级确认 + 低廉 Gas 费」更适合高频收割

-

燃烧机制设计:表面制造通缩幻觉,实则方便庄家左手倒右手,参考某动物币通过 200 次燃烧事件掩盖出货事实的链上数据

六、风险预警:韭菜的 108 种死法

如果你仍想「冲几个 SOL 致敬青春」,请先背诵以下生存指南:

-

合约审计幻觉:98% 的 Meme 币审计报告价值≈方便面包装袋上的牛肉图片

-

流动性陷阱:初期交易深度可能不如乡镇菜市场,一个大单就能让币价表演「自由落体」

-

监管达摩剑:日本金融厅刚起诉某艺人代币项目,罚款金额够买下整条秋叶原

-

技术性收割:从貔貅盘到闪电贷攻击,庄家有 100 种方法让你连裤衩都不剩

七、魔幻现实的终局猜想

这场加密狂欢最可能的结局是:

-

短期:上线首日暴涨 300%,社群疯传「三上老师拯救 Solana 生态」

-

中期:庄家通过 20% 预售份额套现,币价腰斩再腰斩,维权群涌现「还我老婆本」表情包

-

长期:2069 年解锁时,持币人孙子在元宇宙考古课上惊呼「奶奶当年居然买过这种赛博古董」

结语:在疯狂中保持清醒的生存哲学

站在时代的风口,我们不得不感叹:从写真 DVD 到 NFT 再到 Meme 币,三上老师始终走在技术革命的前沿。但作为普通投资者,记住两条铁律:

-

永远用娱乐心态对待 Meme 币:投入金额不超过打赏主播的预算

-

相信市场达尔文主义:所有没被镰刀割死的韭菜,终将在熊市完成基因突变

这位在成人娱乐界拥有 1750 万全球信徒的暗黑系女神,正在用区块链技术重新定义「粉丝经济」。从 DMM 到 DEX,从蓝光碟到代币燃烧,三上老师用实际行动证明:收割韭菜不需要穿衣服。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。