The information, opinions, and judgments regarding the market, projects, cryptocurrencies, etc., mentioned in this report are for reference only and do not constitute any investment advice.

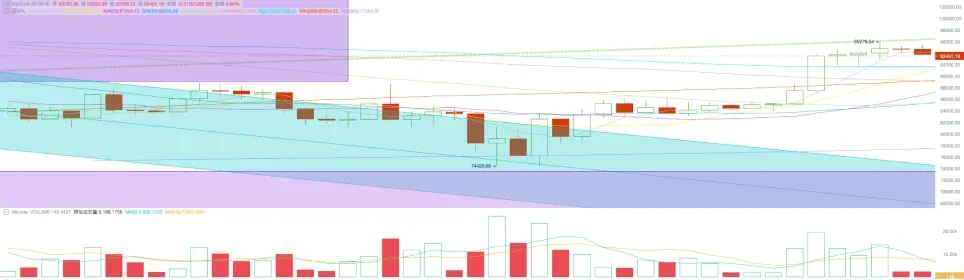

This week, BTC opened at $85,177.33 and closed at $93,780.57, rising 10.10% over the week with a volatility of 12.73%, achieving three consecutive weeks of rebound, and the trading volume has increased. On Monday, it surged strongly, breaking through the key indicator of the 120-day moving average, and maintained its position above this level for the rest of the week, indicating a strong willingness to go long.

Trump's "reciprocal tariff war" is currently in the second phase—"negotiation." The White House continues to release positive signals about progress, while the other negotiating party remains vague, indicating that the outcome of the negotiations is unclear.

Trump has clearly stated that he will not dismiss Powell, which has diminished the trading theme of the past few weeks—concerns over the independence of the Federal Reserve, leading to a "triple kill" of stocks, bonds, and currencies, which would plunge the U.S. economy into greater chaos. Stocks, bonds, and currencies have all stabilized and rebounded.

The Federal Reserve has released positive signals externally. Cleveland Fed President and 2026 FOMC voting member Loretta Mester stated that the Fed is capable of acting quickly if circumstances change. Fed Governor Christopher Waller also indicated that a severe decline in the job market could prompt the Fed to push for rate cuts more aggressively and quickly.

The performance of global markets, especially the U.S. financial trading market, over the past few weeks has fully demonstrated the irrationality and randomness of the "reciprocal tariff war" and its significant impact on the world economic system. The compromises made by Trump and the Federal Reserve in response to the "triple kill" of U.S. stocks, bonds, and currencies indicate that, as mentioned in last week's report, "politics, economics, and markets are primarily operating along a rational path in the medium to long term."

However, it is important to note that the market rebound is a temporary alleviation of concerns that the "reciprocal tariff war" could trigger a market collapse and economic recession. The further trajectory of the market will depend on whether the "reciprocal tariff war" can be resolved in a timely manner and whether the U.S. economy will truly head into recession. Based on this judgment, the ongoing Q1 earnings disclosures in the U.S. stock market are particularly important.

Policy, Macro Finance, and Economic Data

In statements from President Trump and his aides, the reciprocal tariff war is making good progress, especially in negotiations with China, where Trump has expressed confidence in reaching a mutually satisfactory agreement. However, the Chinese government has directly pointed out that no negotiations have taken place between the two sides.

The countries that are genuinely negotiating include Japan and South Korea, where the probability of reaching favorable conditions for the U.S. is very high, and the extent of "concessions" will set a precedent for other countries.

However, there are no signs that the difficult U.S.-China negotiations have entered the actual consultation phase. Therefore, the second phase of the "reciprocal tariff war" has just begun, and significant progress is still a distance away. This limits the time and space for market rebounds, making short-term optimism difficult.

Powell's remarks this week focused on the inflation and economic uncertainties brought about by Trump's tariff policy, setting the tone for the upcoming May interest rate meeting and reaffirming the independence of the Federal Reserve. His rhetoric has remained consistent—

Data-driven policy, maintaining stable interest rates. The Fed will not succumb to political pressure to cut rates but has hinted that if inflation or employment data changes significantly, policy adjustments may occur. Other Fed officials have emphasized their "dovish" stance, indicating a possibility of rate cuts in June.

As of the weekend, the CME FedWatch tool shows a 62.7% probability of a rate cut in June. With the market rebound, this probability has significantly decreased compared to the past two weeks.

On April 23, the released Federal Reserve Beige Book indicated that 8 out of 12 Fed districts reported "no significant change" in economic activity, with overall economic growth slowing. Only a few districts (such as Atlanta and Dallas) reported slight growth, while districts like Boston and Chicago reflected a deteriorating economic outlook. Businesses reacted strongly to the tariff policy, with inflation expectations for 2025 rising to 3.5% in many districts, and manufacturing activity further contracting, with the manufacturing PMI dropping to 48.5. Consumer spending grew moderately, but high prices and tariff expectations began to weaken consumer confidence. Retailers reported inventory backlogs, especially for imported goods, with sales growth falling short of expectations. Employment levels remained generally stable, but hiring activity weakened, with some districts reporting increased layoffs, particularly in retail and manufacturing. Wage growth has slowed but remains above pre-pandemic levels, and labor shortages persist in the tech industry and high-skill positions.

The content of the Beige Book is one of the Federal Reserve's focal points. Its content indicates that the negative impacts of tariffs are beginning to emerge, but the extent is still unclear.

Accompanied by dovish statements from Trump and the Federal Reserve, market panic has eased significantly. The U.S. dollar index rebounded to stabilize at 99.613 after dropping to 97.991. The 2-year Treasury yield fell by 1.42% to close at 3.7560%, while the 10-year Treasury yield dropped by 2% to a neutral zone of 4.245%. Risk markets performed better, with the Nasdaq, S&P 500, and Dow Jones achieving weekly rebounds of 6.73%, 4.59%, and 2.48%, respectively.

The uncertainty of yields saw gold rise to $3,499.93/oz at the beginning of the week, but it subsequently fell sharply over two days, ending the week down.

Selling Pressure and Liquidation

With the significant price rebound, the scale of on-chain selling increased this week, primarily driven by short positions. The total on-chain selling for the week rose to 197,040.26 BTC, with short positions accounting for 190,568.61 BTC and long positions for 6,471.65 BTC. Exchange outflows surged to 62,696.12 BTC, marking the largest net outflow week of this cycle. This outflow has alleviated market selling pressure while also demonstrating strong enthusiasm for accumulation.

Statistics on long and short selling

Long positions increased by over 120,000 BTC this week, and another noteworthy group of long buyers is the "shark" group (addresses holding between 100 to 1,000 BTC), which also saw an increase of nearly 30,000 BTC in a single week.

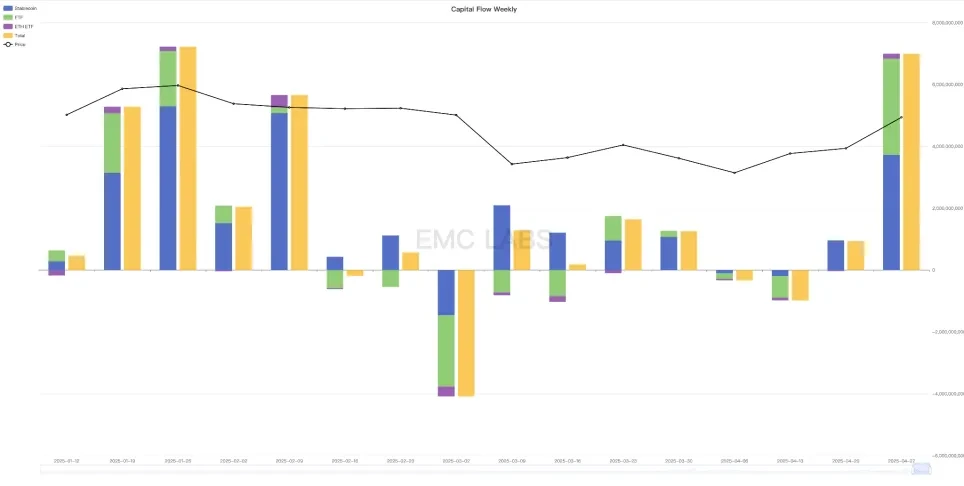

Capital Inflows and Outflows

As the Federal Reserve and the government return to rationality, this week saw a significant inflow of funds into stablecoins and ETFs, totaling nearly $7 billion.

In the seven trading days, six recorded net inflows, indicating that medium to long-term funds are aggressively entering the market. However, it is important to note that as BTC prices rebound to around $95,000, and with the ongoing tariff war conflicts and economic recession concerns, along with the most optimistic rate cuts still a month away, market divergences remain, making short-term fluctuations inevitable.

Cycle Indicators

According to eMerge Engine, the EMC BTC Cycle Metrics indicator is at 0.50, indicating that the market is in a rising continuation phase.

About EMC Labs

EMC Labs was established in April 2023 by cryptocurrency asset investors and data scientists. It focuses on blockchain industry research and investments in the crypto secondary market, with industry foresight, insights, and data mining as its core competencies, aiming to participate in the thriving blockchain industry through research and investment, promoting the benefits of blockchain and crypto assets for humanity.

For more information, please visit: https://www.emc.fund

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。