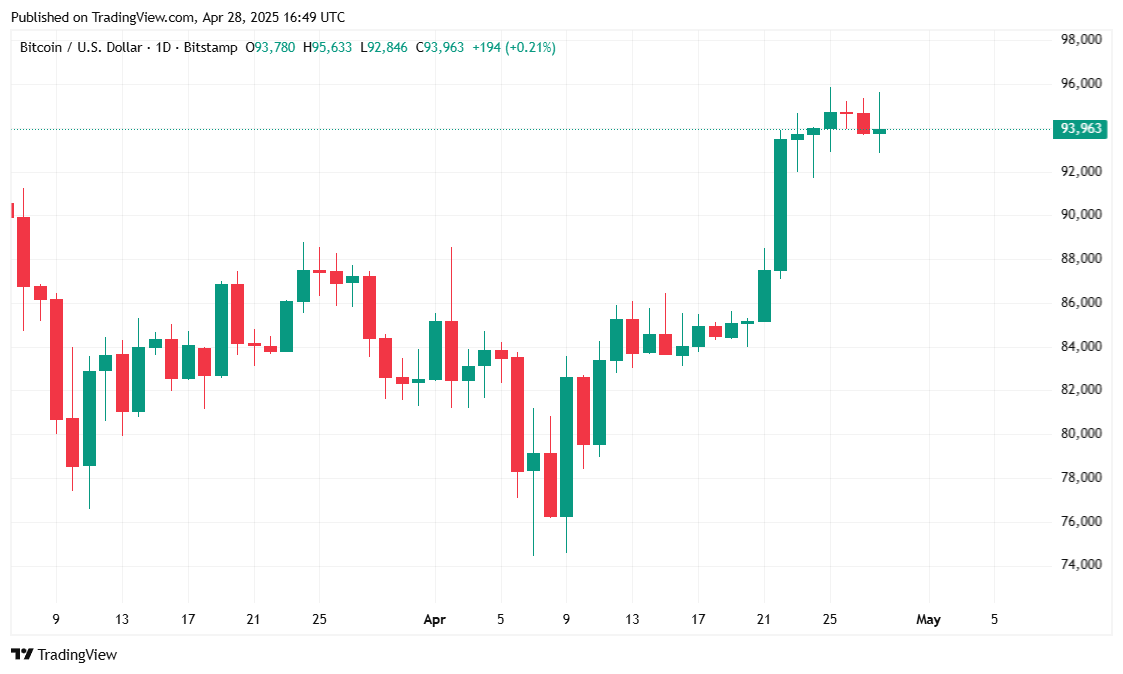

After surging to a two-month high last week, bitcoin ( BTC) dipped to around $92K over the weekend, creating an opportunity for bitcoin treasury firm Strategy, which on Monday announced a purchase of 15,355 BTC for roughly $1.42 billion at an average price of $92,737 per bitcoin.

The digital asset has since rallied all the way to $95K, settling at about $93,966.19 at the time of this writing. Strategy now holds 553,555 BTC and continues to boast the largest bitcoin treasury in the world among publicly traded firms, eleven times more than the next biggest holder, mining firm Marathon Digital Holdings, which currently has 47,531 BTC in its treasury.

London-based bank Standard Chartered, now predicts bitcoin will surge to a new all-time high in the second quarter of 2025 and will more than double its current price by year-end.

“We expect a fresh all-time high in Q2,” the bank said. “Our end-2025 forecast of USD 200,000 will then be in sight.”

Bitcoin is currently trading at $93,966.19, according to Coinmarketcap. The world’s leading cryptocurrency posted a modest 0.11% gain over the past 24 hours and a solid 7.12% increase over the last 7 days. During the latest trading session, bitcoin moved within a range of $92,860.81 to $95,598.49, keeping bullish sentiment intact despite some mid-session pullbacks.

( BTC price / Trading View)

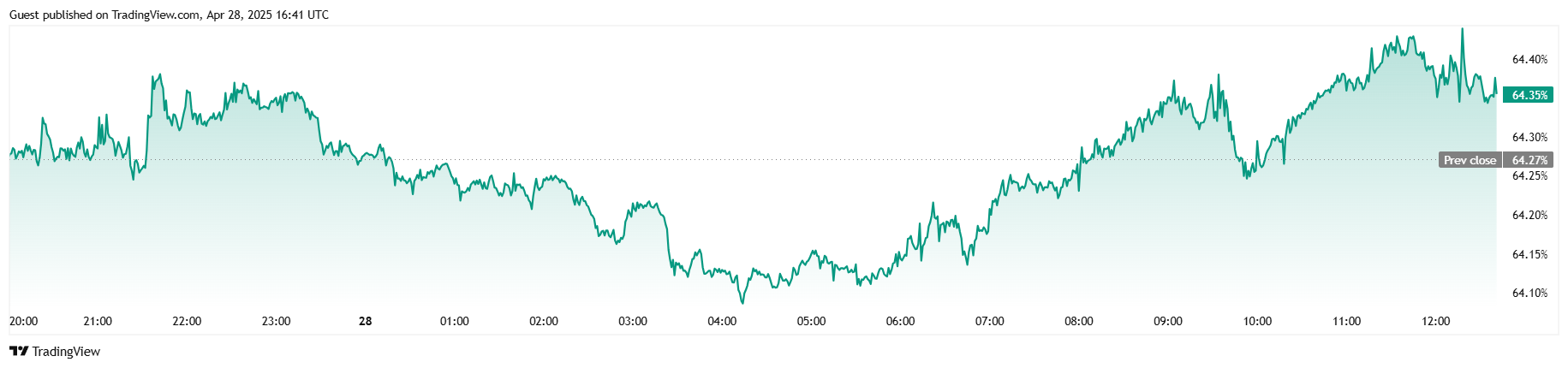

Trading volume saw a notable uptick, jumping 71.64% to $30.46 billion over the past 24 hours, a typical post-weekend surge. Bitcoin’s market capitalization edged slightly higher by 0.09% to $1.86 trillion, while BTC dominance climbed to 64.35%, up by 0.17% on the day. Despite the price and volume rise, futures activity remained relatively flat, with total BTC open interest slipping marginally by 0.12% to $63.525 billion.

( BTC dominance / Trading View)

Liquidation data from Coinglass showed very low stress among traders, with just $2.11 million in total liquidations over 24 hours. Long traders absorbed the bulk of the losses at $1.7 million, compared to only $403,250 in short liquidations. The overall data signals a cautiously optimistic tone for bitcoin, with strong underlying support even as trading activity normalizes after the weekend.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。