STX,Bitcoin第二层协议Stacks的原生代币,在七天内上涨了56%,成为本周100大加密货币中表现最佳的代币,市场对机构采用的期望推动了这一增长。

根据CoinDesk数据,该代币在周五达到了92美分的两个月高点,在过去24小时内上涨超过21%,成为当天最大的涨幅代币。

Stacks是全球领先的第二层协议,用于在Bitcoin区块链上运行智能合约和去中心化应用程序。周二,数字资产托管和基础设施提供商BitGo,作为包裹比特币(WBTC)代币的支持者,向其客户开放了在Stacks上探索收益生成机会的大门,集成了sBTC,这是一种以1:1比例代表比特币(BTC)的合成衍生品。

“SBTC为可编程的去中心化金融产品打开了大门,而不妥协于比特币的核心原则——我们才刚刚开始,”BitGo的产品经理Abishek Singh表示。“在处理超过3万亿美元的交易和超过480亿美元的质押资产的背景下,BitGo独特地处于帮助机构进入比特币新实用时代的有利位置。”

STX在Stacks生态系统中扮演多个角色,包括实现母链与比特币之间的连接,支持智能合约的创建以及实现网络治理。它还用于支付交易费用,并在转移证明共识机制中发挥关键作用,允许持有者通过锁定他们的STX来赚取BTC。

sBTC代币允许持有者参与Stacks的DeFi生态系统,同时保持与其基础比特币的价格挂钩。预计于4月30日实施的sBTC提款功能将允许机构在BTC和sBTC之间无缝移动,为创建包含Stacks智能合约功能和比特币安全性的新的应用程序打开大门。

生态系统流动性改善

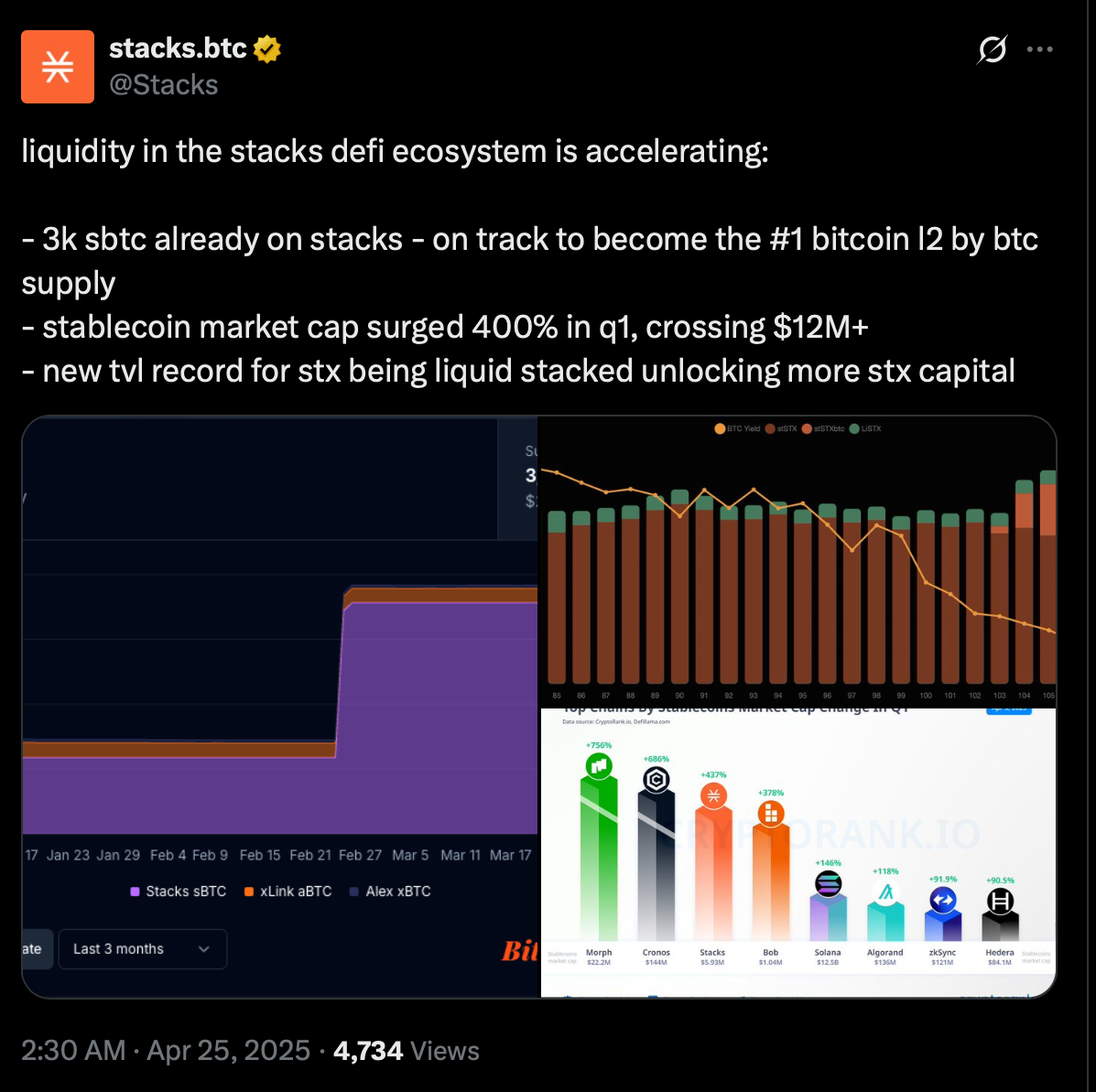

Stacks基础的去中心化金融生态系统的流动性正在改善,该协议在周五早些时候在X上宣布,第一季度稳定币供应量激增超过400%,是Morph和Cronos之后的第三大增长。

根据数据来源DefiLlama,该生态系统中的稳定币总供应量接近700万美元,较1月初的约100万美元大幅上升。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。