师爷聊热点:

市场走势真是跟大家想的不一样啊,之前不少人都觉得漂亮股要是跌了,大饼不仅能扛住,还能逆势往上冲。可昨晚漂亮股又涨了2%以上,大饼不仅没跟涨,反而小幅震荡了。

而今天是本周最后一个交易日,下周就要开始博弈GDP了。最新的GDPNow数据还下调了老美第一季度GDP,这可是五月交易难度的一个大风向标。

大饼最近的表现确实有点佛系,价格虽然有点小回调,但投资者情绪还挺稳的,没啥大起大落。换手率下降了,说明大家交易热情不高。

对于中长线来说,83k的支撑位依旧有点悬。主要原因是这位置没有经历过大洗盘,根基不稳。而93到98k的持仓量区间的人越来越多,而且这些人挺沉得住气。

尤其是之前74k都没跑的投资者,现在更是淡定得很,说人话就不是短线玩家。目前师爷有两种假设,如果95k是这轮反弹的顶,那接下来估计得震荡至少两周。价格在这附近洗洗盘,把不坚定的人甩出去。

如果95k不是顶或者是顶还没到,那么震荡时间可能会更长,价格会一边震荡一边往上试探。但也别指望一下冲太高,因为会是慢慢磨得你心累那种。

而对于眼下这种情况,师爷有几点得说清楚。首先就是别摸顶做空,如果你现在想抓顶然后大干一波空单?糊涂啊兄弟,时机不对,结构也不对,太早了,趋势型的空单现在没戏。

其次就是要回归短线,从75k开始的那波行情,是格局拿多的好时候,大家赚得爽。但现在呢?格局没了,变成了短线选手的盘。快进快出,不恋战。

下周开始,GDP数据就显得比较重要了。GDPNow已经下调了预期,如果正式数据再拉胯,漂亮股可能会抖一抖,单咋走还得看情绪传导。

不过就目前看大饼的投资者还挺冷静,估计不会轻易崩盘。短线为主,盯着83k的支撑和93到98k的压力,不要总是赌趋势!

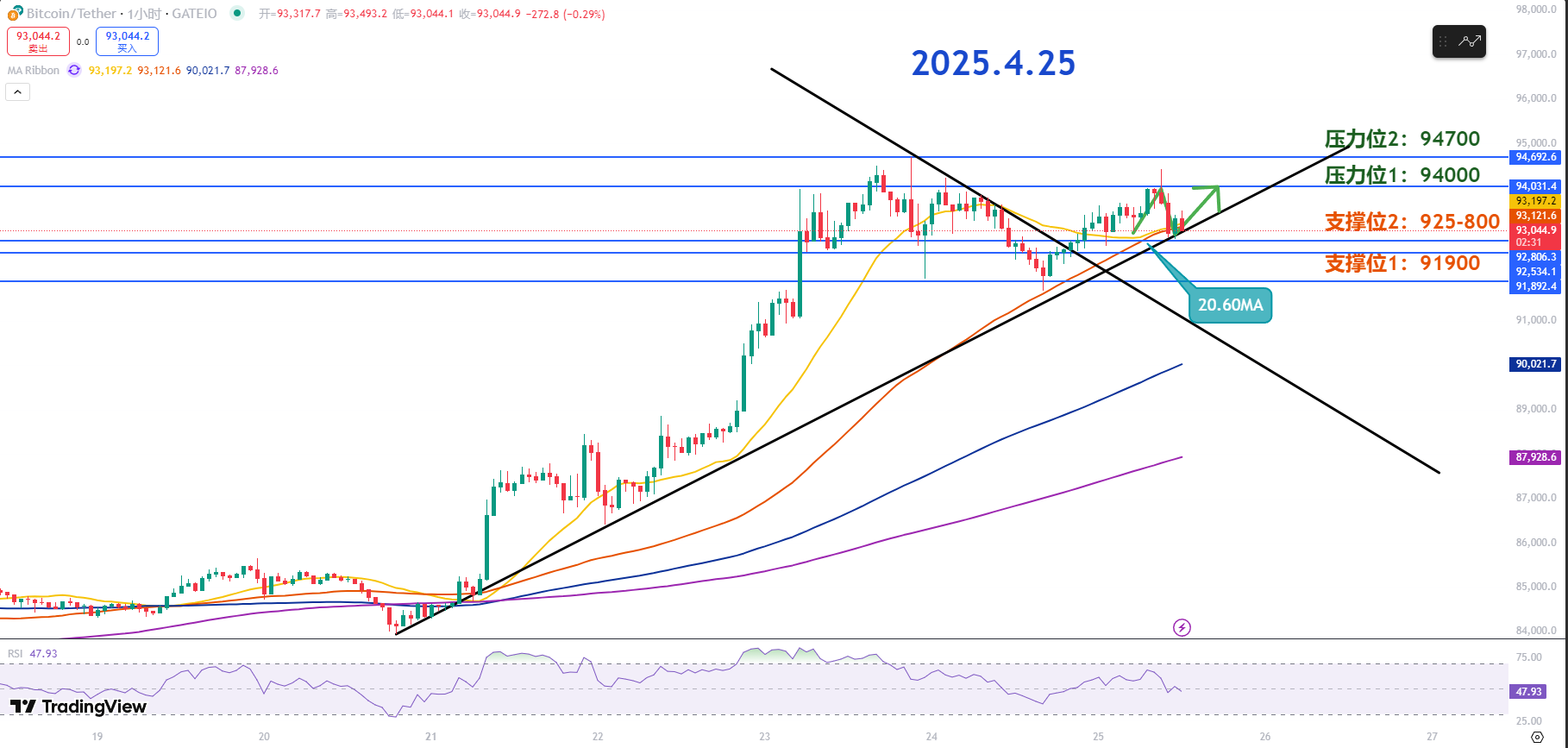

师爷看趋势:

阻力位参:

第一阻力位:94700

第二阻力位:94000

支撑位参考:

第一支撑位:92500-92800

第二支撑位:91900

今日建议:

比特币目前正尝试进行一次彻底的趋势反转。特别是在价格反弹的区间内,横盘结束后如果价格能够获得买盘支撑且不跌破前期的低点,则可以期待阶梯式上涨。

另外关键是当前价格是否能够维持稳定,并且不跌破重要的前期低点。这也是判断趋势延续性的重要依据。

像93K、94K这样整数关口的价格,在心理层面可能会形成阻力。在价格反弹的区间内,心理支撑区域可能会出现暂时的回调。

如果价格成功突破第一阻力94k,则可将目标上调至94.7K。在到达95K之前,94.7K是一个重要的阻力位。如果此时出现轻微调整,则可能为进一步上涨提供机会。

昨日的92.5K是重要的支撑位,随着图表显示反弹趋势,支撑也需要相应上调至92.5到92.8的区间,以便更好地设定盈亏比,进行风险管理。

为了维持当前的反弹势头,价格最好能够守住92.5到92.8的区间。如果跌破这一区间,则可能下探至昨日形成的前低91.9K。在交易量较小的情况下,这一低点可以作为超短入场机会。

4.25师爷波段预埋:

做多入场位参考:91900-92500区间轻仓多 目标:94000-94700

做空入场位参考:暂不参考

本文内容由师爷陈(公众号:币神师爷陈)独家策划发布,师爷陈全网同名。如需了解更多实时投资策略、解套、现货,短、中、长线合约交易手法、操作技巧以及K线等知识可以加到师爷陈学习交流,现已开通粉丝免费体验群,社区直播等优质体验项目!

温馨提示:本文只有专栏公众号(上图)是师爷陈所写,文章末尾及评论区其他广.告均与笔者本人无关!!请大家谨慎辨别真假,感谢阅读。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。