撰文:Stacy Muur

编译:Odaily 星球日报 Golem(@Web3_golem)

先有 Web3 的舞台,然后才会诞生主角。

当一个协议火起来的时候,我们可以在社交媒体上看到人们滔滔不绝地谈论它,其他所有项目要么开始「巴结」它,要么开始模仿它。你应该懂那种感觉,在 Pump.fun 上绝对有感受,如果你久经沙场,还可以在 FriendTech、Farcaster、Bananagun 和 Unibot 等上找到同样的感觉,它们各自有各自的周期。

残酷的现实是,Web3 的舞台永远在,炒作总是会继续下去,但主角总是频繁更换。不是因为产品失败了,而是因为人们发现了更耀眼的东西。在这个领域,人们对新奇事物保持新鲜感的时间很短,聚光灯永远不会过多停留。

这不是一篇悼词。虽然并非所有曾经热门的协议都已消亡,但它们都经历了从火爆到沉寂的周期。这篇文章讲述的是那些曾经拥有光环的项目,以及当它们不再是头版头条时,会是什么样子。

谁是「过气明星」

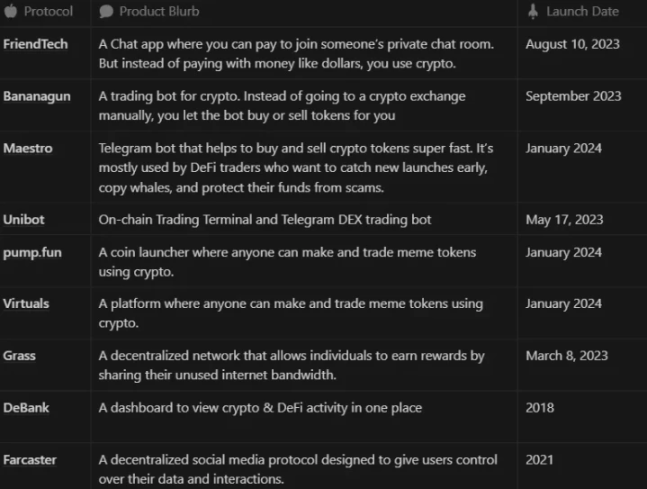

如果在 Web3 待的时间足够长,就足以看出一种循环:一个协议火了起来,占领了所有人的时间线,最后销声匿迹。下表是一张快照。它衡量的不是总锁定价值 (TVL) 或代币价格,它衡量的是更难以捉摸的东西:注意力、记忆力和情感相关性。这些项目是曾经的明星,有些至今仍存活。

Web3 过气明星

以 FriendTech 为例,它的崛起迅速而高调,但它的衰落却是彻底的。没有路线图,没有用户粘性,没有复苏迹象。跌落神坛后,人们明白它只是徒有其表。

Unibot 稍微好些,它经历了黑客攻击、复制品竞争和市场衰退,但目前依然被公认为是同类产品中交易体验较为出色的。

Virtuals 是少数不仅幸存下来,而且实现了转型的公司之一。它最初是一个基于 Base 的预测平台,现在将自己定位为「AI 代理中的华尔街」。这种转变在加密领域并不容易,尤其对诞生于「degen casino」(去中心化赌场)的项目来说更是如此。

Pump.fun 和 Maestro 并没有消亡,只是市场被稀释了。它们仍在运作,仍然活跃,用户活动量激增,但现在已经没有人称它们为革命性的了。Meme 币制造机器和狙击机器人网络从来都不是为了持久而建造的;它们是为了轰动而生的。它们确实做到了,并且不止一次。

还有一些慢热型项目,如 Grass, DeBank, Farcaster,它们都有各自的特色:投机收益、DeFi 社会身份和去中心化社交等。它们都不是浮华的项目,也没有消亡,它们只是在炒作期之后悄无声息地发展。

仍在建设,仍在迭代

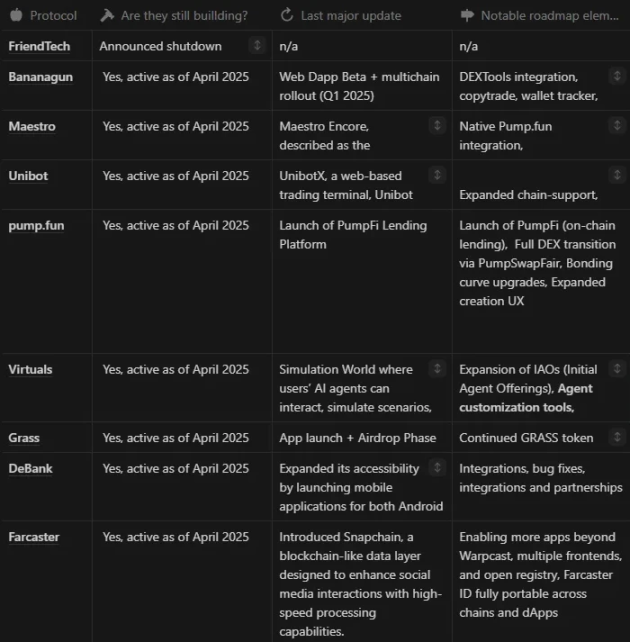

如果说第一张表格衡量的是注意力,那么下表则关注的是完全不同的东西:毅力。一个项目的炒作期会很热闹,但正在建设过程却很安静和难熬的。

以上有一些协议虽然没有被大众炒作,但它们并没有停止发展。这张表格描绘的是那些不为人知的现实,在聚光灯移开很久之后,谁仍在推动更新、扩展集成或强化基础设施。

不幸的是,FriendTech 率先放弃,已于 2024 年 9 月正式关闭。其余的项目仍在悄无声息地增长,不是在推特的推送时间线上,而是在项目更新日志中。

峰值活跃度 ≠ 项目持久性

我们总能感受到一个项目正在峰值。Telegram 卡到无法滚动,社区充斥着跟单者和一些新人朋友半生不熟的帖子,该协议的网站在炒作的重压下瘫痪。但这种状态稍纵即逝,以下是一些项目巅峰期和过后的数据对比。

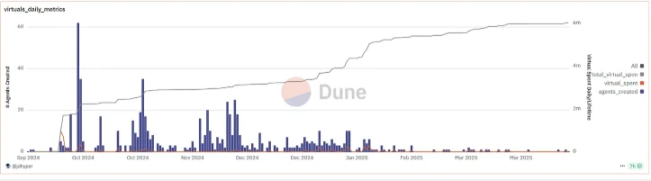

Virtuals

Virtuals 在 2024 年 10 月迎来了代理创建高峰,单日新增代理超过 60 个,随后在 11 月和 12 月掀起了一波实验热潮。但到 2025 年初,每日代理创建数量已降至个位数。

香蕉枪 (Bananagun)

2024 年 7 月,Bananagun 的用户活跃量达到顶峰,超 7 亿。但九个月后,只有 1.246 亿,跌幅达 82% 。

Bananagun 仍在运行和开发中,但已不再是用户首选。Telegram 机器人已经充斥市场,狙击成为了一种常态。市场格局在不断变化,Bananagun 并没有消亡,只是逐渐淡出了人们的视线。

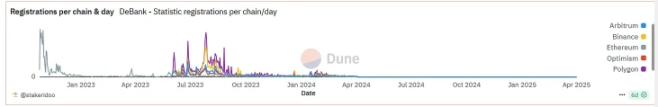

DeBank

DeBank 在 2023 年中经历了多链注册量的激增,随后便进入了停滞状态。到 2024 年初,新用户已经停止涌入。产品本身并没有缺陷,只是市场格局变化了。DeFi 社交听起来不错,但人们并没有为此留下来。也许他们只是用 DeBank 跟踪了几个钱包而已,然后就离开了。

Farcaster

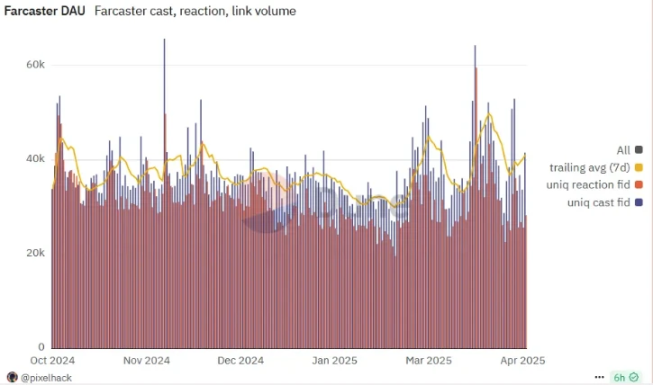

Farcaster 是静默复利 (quiet complication) 的典范。自 2024 年末以来, 其日活跃用户 (DAU) 一直稳定在 2 万到 5 万之间,用户参与度也始终如一,没有出现大幅飙升,也没有空投诱饵,只有真实的使用量。虽然大多数社交协议都在追逐流量,但 Farcaster 却正在养成习惯,这可能才是真正的优势。

Pump.fun

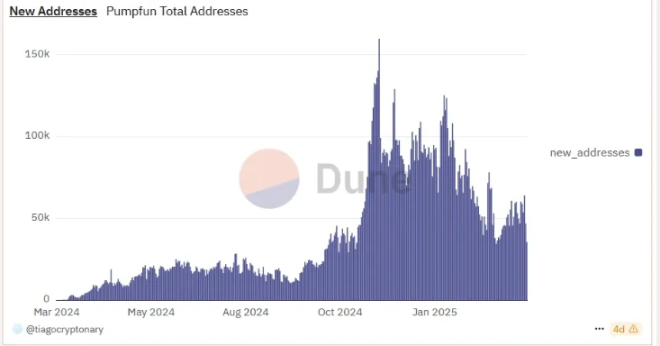

Pump.fun 就像一座火山。2024 年末,在其平台创造了数百万个 Meme 币,高峰期新增钱包超过 15 万个。但此后,趋势便急剧下降,但它并没有消亡。目前在 Pump.fun 平台每日稳定诞生 5 万到 6 万个 Meme 的水平,只是它已不再处于聚光灯下了。

曾经我们都为哪些叙事买单了?

你可以在仪表盘上追踪项目的使用情况。但叙事存在于其他地方。为了理解这一点,我们必须重新回忆它们真正意义非凡的那一刻。FriendTech 将社交影响力转化为流动性,Pump.fun 改变了代币发行规则,而 Farcaster 则不仅仅是一款社交应用,更是一份 Web3 独立宣言。

人们不仅仅使用这些协议,而是将自身与之契合。FriendTech 让我们觉得自己很有影响力,Pump.fun 让我们觉得自己很有智慧,Farcaster 让我们觉得自己身处一个比 Twitter 更纯粹的平台。

FriendTech

FriendTech 的叙事极具吸引力:将你的社交图谱代币化,将影响力货币化。在其巅峰时期,它不仅仅是一个 SocialFi 工具,更是地位即资产的象征。但这个叙事最终不堪重负而崩塌。没有路线图,没有参与循环,没有文化传承。这是一个罕见的案例,使用情况、叙事和产品都同步消失。它既是一次干净利落的崛起,也是一次干净利落的消亡。

Bananagun

Bananagun 讲述了公平竞争的叙事。快速狙击,智能代币经济学,以及面向日常交易者的机器人。它在 Telegram 机器人浪潮中蓬勃发展,凭借更敏锐和更快的速度赢得了声誉。现在它仍在运行,仍在为交易者服务,但它已成为基础设施,虽然有用,但不再引领趋势。

Unibot

Unibot 专注于交易速度和精度。它将自己定位为最敏锐的 Telegram 交易者的工具,这不仅仅是一款产品,更是一种身份认同。尽管面临竞争甚至黑客攻击,Unibot 的形象依然屹立不倒。它的功能不断扩展,用户群也经久不衰。它不依赖病毒式传播,而是依赖可靠性。这个叙事至今仍旧适用。

Pump.fun

Pump.fun 使代币创造去中心化,并随之带来暴富故事。在巅峰时期,感觉每 10 秒就会诞生一个新的代币,但市场很快就饱和了。如今,它仍然活跃,但魔力已经消失了。「人人都能发行代币」的叙事在「PVP」中失去了光彩。

Virtuals

Virtuals 最初是一个基于 Base 的投机中心,它理解注意力,但后来发展到支配了注意力。它转向 AI 代理平台,将自身重新定义为比预测市场更大的叙事。现在,它不再追逐 Meme,而是在构建基础设施。「AI 代理界的华尔街」是一个更大胆、更持久的叙事,它是本文中为数不多的能改写自身叙事的协议之一。

DeBank

DeBank 告诉市场,用户的 DeFi 投资组合就可以构成他们的身份,它让钱包追踪变得具有社交性。曾经这个叙事确实有效,但却一直停滞不前。DeBank 产品仍然功能齐全,在高级用户中备受推崇,但它从未从工具跃升成为网络。某种程度上,DeBank 是其自身用户体验稳定性的牺牲品,它好到让人无法忽视,却又缺乏足够的吸引力让人主动推广。

Farcaster

Farcaster 的初衷是:拥有你的社交。它并非试图复刻推特,而是重新构想了链上发布、互动和构建的模式。目前的情况证明了一点:Farcaster 并未衰落。它一直在缓慢地积累信任和吸引力,作为长尾叙事,不追求病毒式传播将更具韧性。

哪些曾经热门项目快要「死亡」

除了以上提到的知名例子外,其他一些协议也曾在短期内获得过显著关注,但之后用户活跃度、交易量或相关数据都明显下降。这些项目并非边缘项目,在巅峰时期,它们也引领了市场叙事,并引起了人们的强烈关注。本节重点介绍其中一些案例。

Blast

在 2024 年 7 月的积分驱动热潮中,Blast 月活跃用户数达到 90 万的峰值。目前月活跃用户数约为 12 万,在用户积分疲劳出现后,收益叙事也迅速消亡。

Scroll

在 zkEVM 炒作达到顶峰时,Scroll 月活跃用户数达到 120 万,但目前约为 11.1 万。Scroll 仍在运行中,但随着基础设施转向性能优先的叙事,市场对其新鲜感逐渐消退。

Starknet

Starknet 曾经过桥存款达到 16 亿美元,但目前约为 3.9 亿美元。一些开发者的忠诚度依然存在,但由于成本和工具摩擦,主流采用已经有所放缓。

Renzo Protocol

Renzo 月活跃用户数巅峰达 15.5 万,目前略低于 1.9 万。虽然其在流动性再质押赛道仍然具有影响力,但光芒已经被更强大的 EigenLayer 生态系统参与者所掩盖。

Sushiswap

Sushiswap 巅峰交易量达到 113 亿美元。目前交易量约为 2 亿美元。这是一个警示故事,它表明碎片化、治理扩张以及中心化交易所 (CEX) 的竞争都将削弱先行者的优势。

以上这些协议都曾一度被视为行业领导者。虽然有些协议仍然活跃,但它们的数据表明,如今用户与它们的互动方式发生了转变。这种下降究竟是源于市场环境的变化、叙事的演变,还是仅仅是因为有更强大的市场力量?给我们的教训始终如一,早期的增长势头与项目长期持续存在并无相关性。

结论

在 Web3 中,大多数叙事并没有消亡,只是不再被谈及。本文中的项目并非因为失败而被选中,而是因为它们在短时间内具有重要意义。虽然它们确实失败了,原因不是因为它们失去了资金或用户,而是因为它们失去了叙事动能——一种将产品转化为行动的难以衡量的力量。

更深层次的模式在于信念的情感弧线。当这条弧线变平时,用户就会离开,不是因为他们失望,而是因为不再有留下的理由。

这就是 Web3 中长寿项目如此罕见的原因。为了持久,协议不仅需要是可用的,还必须在叙事上充满活力。它需要提供的不仅仅是收益或工具,还需要身份、可能性以及「我明天还会回来」的理由。

Web3 下一个叙事突破不会仅仅来自于解决了某些问题,同时将来自于某种意义。而那些值得关注的项目也在炒作过后默默建设,等待着它们的第二个时刻。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。