原文标题:《如果没有合规红利,Coinbase 还剩下什么?》

原文作者:Fairy,ChainCatcher

在监管优势构筑起的护城河内,Coinbase 是合规领域的「金字招牌」。但褪去合规的光环,它那份「高贵冷漠」正变得越来越危险。

社区的反馈被无视、客服响应迟缓、手续费高.... 这些问题让越来越多的用户感到失望和不满。一个问题日益尖锐:如果没有合规红利,Coinbase 还剩下什么?

个人用户去哪儿了?

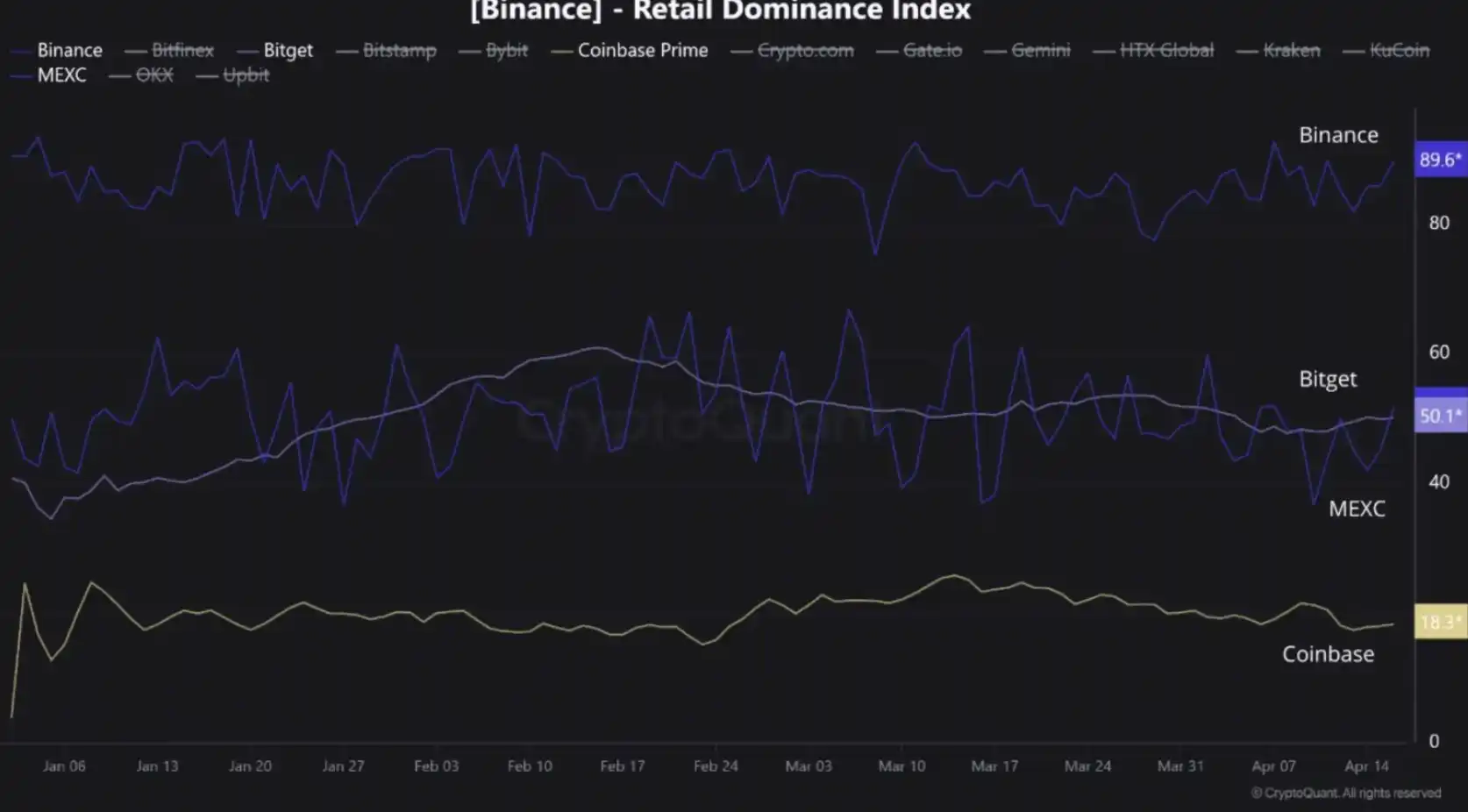

据 CryptoQuant 数据显示,Coinbase 的个人投资者主导指数仅为 18.3%,远远低于 Binance 的 89.6% 和 Bitget 的 50.1%。这项指数反映了交易平台中个人投资者相对于机构投资者的活跃程度和影响力,数值越高,表示用户群体中个人投资者占比越大。

这一数据背后,揭示了 Coinbase 长期以来专注于合规和机构化的战略方向,也表明它正逐渐与普通用户渐行渐远,平台对大众市场的吸引力和粘性在下降。而这一点也得到了社区的广泛反映,无论是在中文社区还是英文社区,关于 Coinbase 的负面评价日益增多,用户的声量愈发高涨。

图源:CryptoQuant

Coinbase 的「入账玄学」

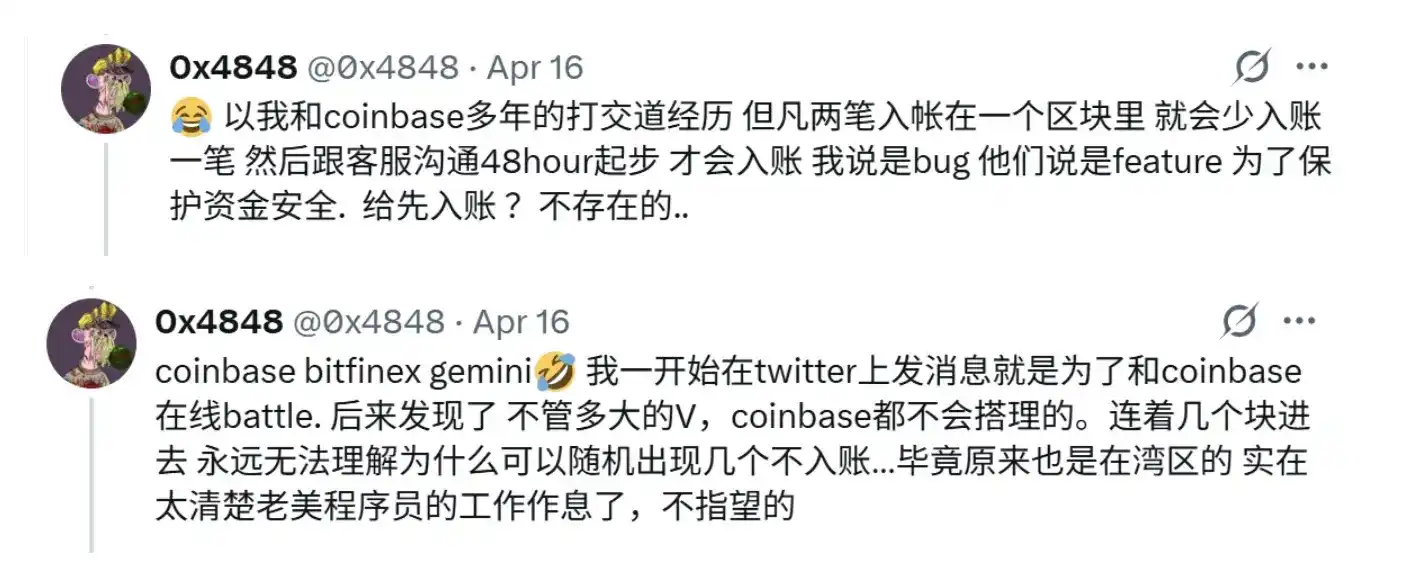

有用户反馈称,当两笔交易在同一区块中处理时,Coinbase 系统可能只入账一笔,另一笔则需耗费几天与客服拉锯,才得以恢复。用户 @0x 4848 表示:「我说是 bug,他们说是 feature,为了保护资金安全。」

这类「以安全为名」的问题,如果没有高效透明的处理机制,就会变成对用户耐心与信任的透支。

客服:慢是一种常态

Coinbase 的客服系统早已成了「槽点集中营」。许多用户反映,Coinbase 的智能助理形同虚设,无法真正解决问题。

而一旦选择人工客服,等待的噩梦才真正开始。人工客服权限极低,常常只能「记录问题并向上反馈」。根据用户反馈,收到初步回应最少要等上 48 小时,而完整地解决一个问题,甚至可能需要一周甚至更久的时间。

此外,部分用户称其客服沟通机制混乱低效。「他们一直通过电子邮件来回向我索取同样的信息,我提供了,他们又说不够。」用户 @MattLGov 表示,「与 Coinbase 客服打交道绝对是件可怕的事。」

图源:@0x Ponga、@MattLGov

外有诈骗围猎,内有员工越界

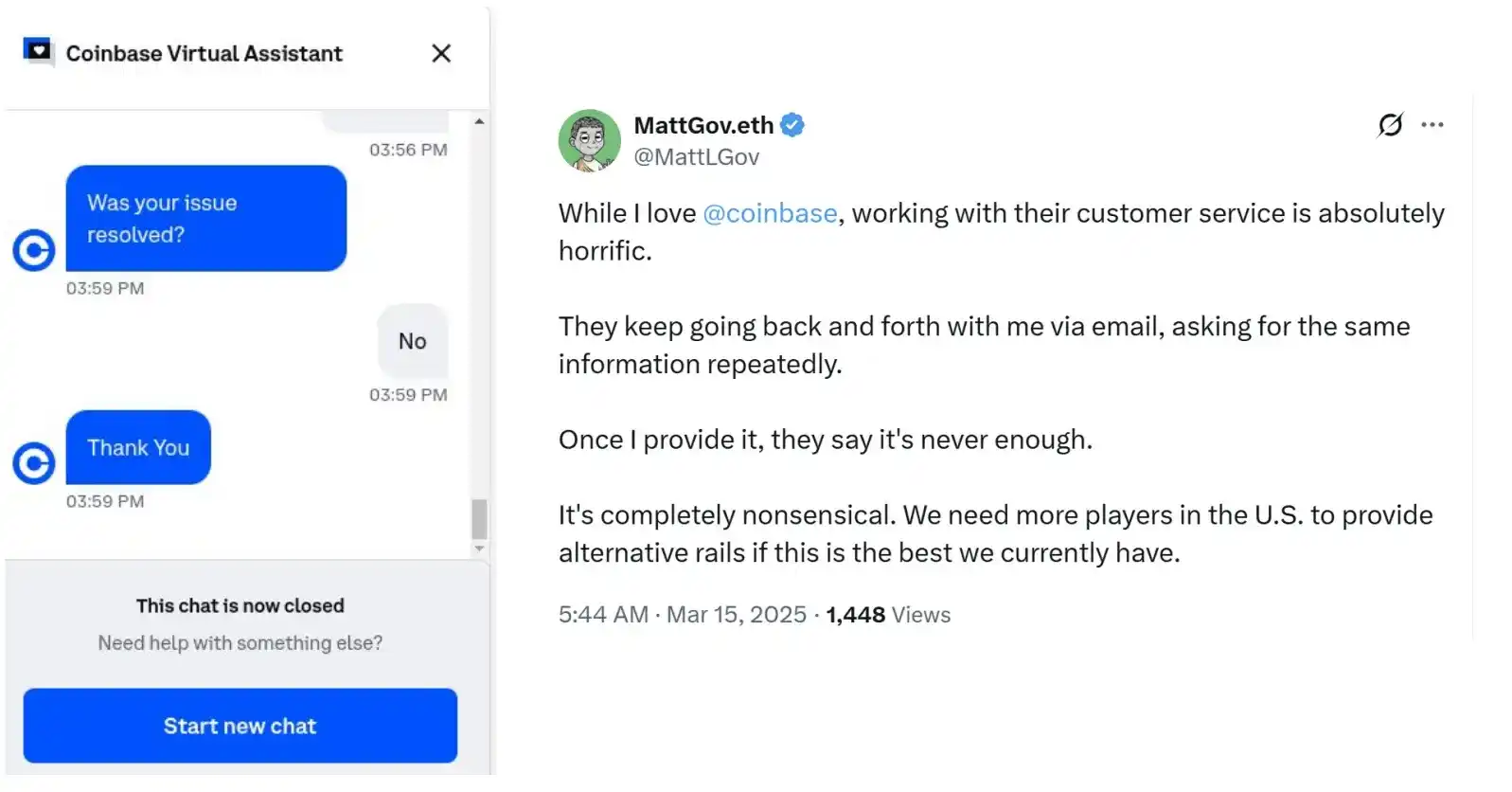

Coinbase 用户频频成为诈骗目标。链上侦探 ZachXBT 披露,仅上月相关案件就造成高达 4600 万美元的资金损失。

与此同时,Coinbase 内部也爆出数据安全问题。The Block 联合创始人 Mike Dudas 在 X 平台称,自己收到官方邮件,显示一名员工可能违规访问了部分用户账户数据,其中包括他本人。邮件写道:「我们检测到有迹象表明,一名员工可能以不符合内部政策的方式,查看了少量客户的账户记录。」(相关阅读:一年损失 3 亿美元,Coinbase 用户频遭精准诈骗,背后竟藏「内鬼」泄露信息?)

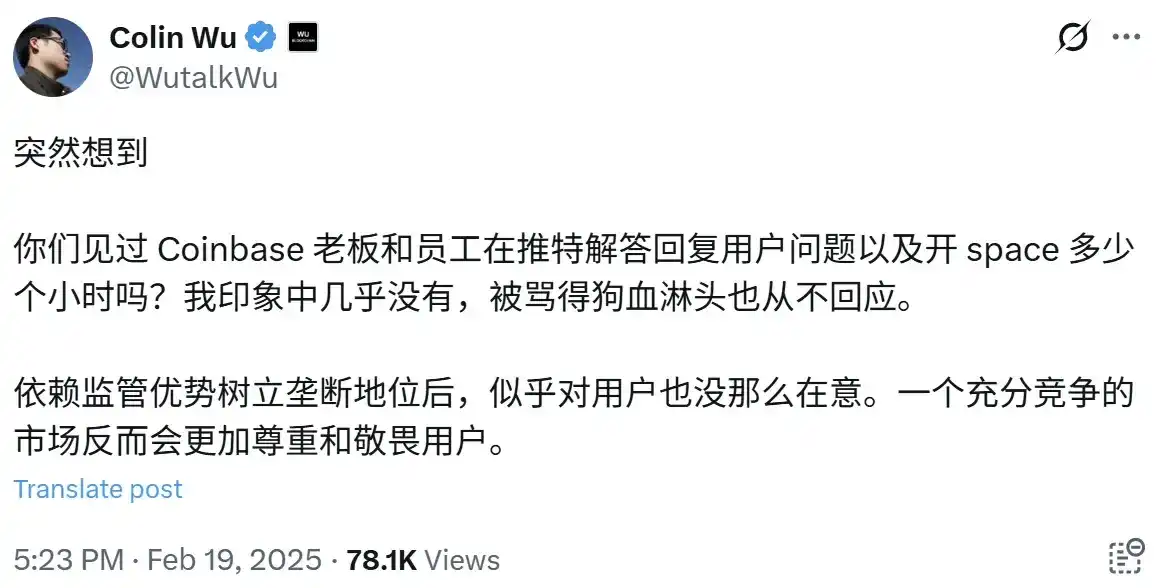

「已读不回」的冷漠风

在用户沟通方面,Coinbase 的存在感几乎为零。它不面向散户,也没有建立起有效的用户交流渠道。无论是 CEO 还是高管团队,几乎很少在社交平台上公开回应用户问题,哪怕在遭遇大量投诉和质疑时,也极少见其出面澄清或解释。

这种「沉默」背后,或许有其文化背景和监管考量,但结果却是用户的声音很难被听见。

图源:@WutalkWu

「贵族式」手续费

用户 @hyperunit 整理了主流交易平台按初始手续费等级购买 1 枚现货比特币的成本,结果显示 Coinbase 的费用达 329.68 美元,处于较高水平。此外,社区用户 @Tmzhao 1 指出,若想在 Coinbase 获得与 Binance 普通用户相同的手续费等级,用户需要从 VIP 0 起步,完成约 2.5 亿美元的交易量,支付超过 30 万美元的累计手续费。

尽管 Coinbase Pro(现为 Advanced Trade)提供更低的手续费选项,但其操作界面相对复杂,许多普通用户并不熟悉或容易上手。

图源:@hyperunit

Coinbase 的合规光环,毫无疑问是它在美国市场稳坐一席之地的基石。然而,随着它不断加码对机构的依赖,似乎也逐渐淡化了与普通用户之间的联系。在这条追求合规与安全的道路上,Coinbase 正悄然牺牲着用户体验,放弃了对平台运营与服务的精细打磨。

在这艘巨轮前行的背后,散落的却是无数用户的低语与期许,他们的声音逐渐被吞没在繁琐的流程与冷漠的机制中。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。