Macroeconomic Interpretation: The remote confrontation between Powell and Trump has become a market barometer. The Federal Reserve Chairman warns that tariffs will drive up inflation and unemployment, while Trump seems to be shifting blame, angrily criticizing Powell three times on social media in one day, stating, "Powell's interest rate policy is always late and wrong," even threatening to fire the Fed leader and calling for him to "resign as soon as possible," accusing him of "playing politics" and being "too bad," while again pressuring for interest rate cuts, believing Powell "should have lowered rates like the European Central Bank long ago." This power struggle between the White House and the central bank has left the market with increased uncertainty regarding policy. The three major U.S. stock indices have also fallen for three consecutive weeks, while the volatility in the crypto market has unusually narrowed, with the "Fear and Greed Index" remaining at a relatively low level, and the long-short ratio data indicating that short positions are quietly accumulating.

As Trump's tariff plans seem to be winding down, the Fed, led by Powell, finds itself in a dilemma regarding inflation discussions and the path to interest rate cuts. During this period, Bitcoin has experienced both fluctuations and rapid rises and falls. Behind this game, there are whales holding tens of thousands of BTC silently increasing their positions in the deep sea, retail investors trading in the short term, and Swiss banks predicting that altcoins will make a comeback in 2025— the script of the crypto world is far more intriguing than the linear logic described by Wall Street analysts.

The first "thunderbolt" on the global economic chessboard comes from institutional research warning of a 65% recession probability. A former Fed official sharply points out that the current 4% core inflation rate is dangerously misaligned with the Fed's pace of interest rate cuts; if prices spiral out of control again, aggressive rate hikes could severely damage the economy. This stagflation risk resonates with Trump's tariff offensive: the U.S. tariffs on China act like an "economic boomerang," ultimately raising domestic prices and impacting financial markets. Historically, protectionism has never led to global economic progress. When the tariff war meets the interest rate cut dilemma, the market provided the most honest feedback on April 18— the Dow Jones faced another decline, gold broke through the historical high of $3,660 per ounce, while Bitcoin fluctuated around the $84,000 mark, seemingly searching for a balance point between traditional and emerging safe-haven assets.

In this battle for safe-haven assets, a report from JPMorgan shows that despite the ongoing geopolitical risks, funds prefer gold ETFs over crypto ETFs, leading to a more than 20% pullback in BTC since Trump took office. However, on-chain data reveals a different picture: Coinank monitoring shows that whales holding over 10,000 BTC are leading the market with a 0.7 accumulation rate, while the sentiment index for medium-sized investors holding 10-100 BTC has quietly risen to the critical point of 0.5, suggesting that "silent large holders" are positioning themselves. This cognitive gap between institutions and retail investors, along with the time lag in information between major holders and ordinary investors— when exchanges circulate over 15,000 BTC, it seems like a strategic accumulation of coins.

The long-short game in the crypto market is further complicated by the tug-of-war between regulation and innovation. Some institutions predict that as the U.S. stablecoin regulatory framework advances, altcoins may experience a major explosion in Q2 2025. This optimism is based on a subtle premise: as Bitcoin's market share falls from a four-year high of 67%, funds will reassess the performance and user stickiness of public chains. However, reality often plays tricks— high-performance blockchains may solve the technical dilemma of the "impossible triangle," but they struggle to escape the commercial curse of "getting applause but not sales." This reminds one of the internet bubble era: in 1999, Amazon's stock price also plummeted by 80%, but it persevered into the cloud era and became a giant. Perhaps the current dormancy of altcoins is accumulating momentum for future value reconstruction.

In this global capital migration, Bitcoin is experiencing a painful period of identity recognition. It is seen as "digital hard currency" in the eyes of whales, yet as a "high-risk asset" in the hearts of retail investors; it is constrained by the Fed's monetary policy while benefiting from the safe-haven demand arising from geopolitical conflicts. Perhaps, as JPMorgan CEO Dimon said, when the U.S. shakes the foundation of global trust due to trade wars, the value consensus of decentralized assets will truly face the test. History does not repeat itself, but it often rhymes— the collapse of the Bretton Woods system in 1971 gave rise to a bull market in gold; will the tariff smoke and interest rate cut dilemma of 2024 become a turning point for crypto assets to break free from their shackles? The answer may lie in the wallets of every holder, waiting for time to reveal it.

BTC Data Analysis:

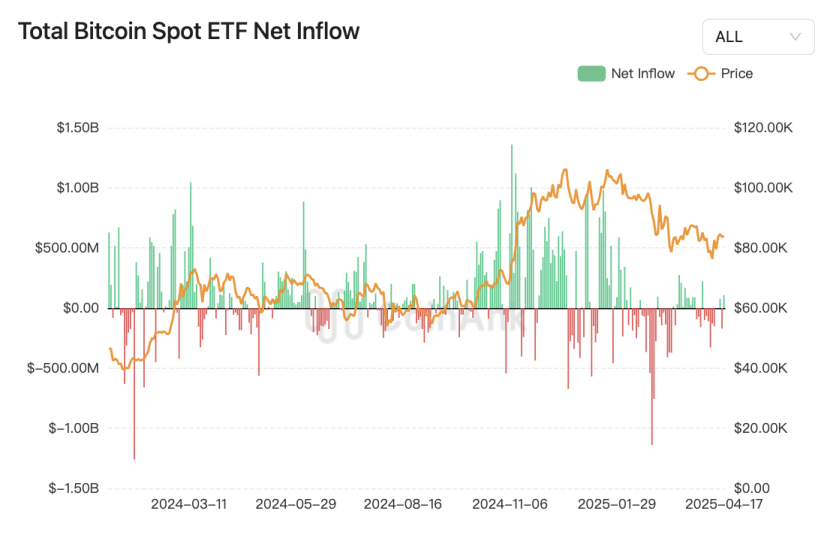

Coinank data shows that yesterday, the #BTC spot ETF rhythm was unusually consistent, with a total capital injection of $108 million across 12 products in a single day, with no outflows.

We believe that this capital movement reflects institutional investors' ongoing demand for allocation to crypto assets. The scale effect of leading #ETFs validates the attractiveness of compliant investment channels to traditional funds, and the market share difference between BlackRock and Fidelity (with IBIT's cumulative scale exceeding FBTC by 3.5 times) highlights the competitive advantage of leading institutions in licensing resources and liquidity management. The 5.59% market cap share indicates that ETFs have become an important value anchor in the Bitcoin ecosystem, and the year-on-year increase in capital accumulation (approximately 42% growth since the beginning of the year) suggests an acceleration of institutionalization.

In the short term, ETF capital inflows will strengthen Bitcoin's price resilience, with the $108 million increase equivalent to 1.7 times the income of Bitcoin miners during the same period, forming significant premium support. In the long term, the 5.59% market cap share approaching the regulatory threshold for traditional ETF benchmark assets may trigger a reassessment of market manipulation risks by regulatory agencies. It is worth noting that approximately 63% of the cumulative net inflow of $35.375 billion is concentrated in IBIT; this concentration trend may exacerbate market volatility sensitivity, necessitating caution regarding the liquidity risk of a single product's impact on the overall market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。