Memecoin 是 rug pull事件的罪魁祸首。

撰文:Stephen Katte,CoinTelegraph

编译:五铢,金色财经

与 2024 年相比,今年的加密货币 rug pull 案例同比下降了 66%,但最近的数据显示,每次 rug pull 的规模一直在增加。

根据区块链分析平台 DappRadar 4 月 16 日的报告,rug pull 事件发生频率逐年下降,2024 年初记录了 21 起独立事件,而 2025 年迄今为止仅为 7 起。

然而,根据 DappRadar 的报告,自 2025 年初以来,Web3 生态系统因欺诈行为损失了近 60 亿美元。然而,报告将其中 92% 的跌幅归咎于 Mantra 的 OM 代币崩盘,而创始人强烈否认这是一起阴谋。

相比之下,在 2024 年初的同一时期,rug pull 造成的总损失达到了 9000 万美元。

DappRadar 分析师 Sara Gherghelas 表示:「这种转变表明,rug pull 黑手的现象正在减少,但一旦发生,破坏力却要大得多。」

「这些骗局越来越复杂,往往由拥有精致品牌和精心策划的叙述的团队精心策划。」

Memecoin 是 rug pull事件的罪魁祸首

Gherghelas 表示,rug pull的性质正在不断演变。 2024 年第一季度,大多数源自 DeFi 协议、NFT 项目和 memecoin。在 2025 年的同一时间段内,大多数 rug pull 都发生在 memecoin 中。

Libertad 项目的原生 Solana 代币 Libra (LIBRA)是近期备受瞩目的 rug pull案例之一; 2 月 14 日,在阿根廷总统哈维尔·米莱 (Javier Milei) 在 X 上发布消息后,该公司市值上涨至 45.6 亿美元。

在他删除帖子后,该代币价格下跌了 94% 以上,引发了人们对其哄抬价格的指控。

Gherghelas 表示:「欺诈和退出骗局仍然是一个持续存在的威胁,尤其是在那些项目可以通过炒作迅速获得关注,却可能在一夜之间卷走用户资金而消失的生态系统中。」

「尽管人们的意识不断提高,检测可疑行为的工具也越来越多,但 rug pull 仍然是一个反复出现的问题,尤其是在 DeFi 和新推出的代币生态系统中。」

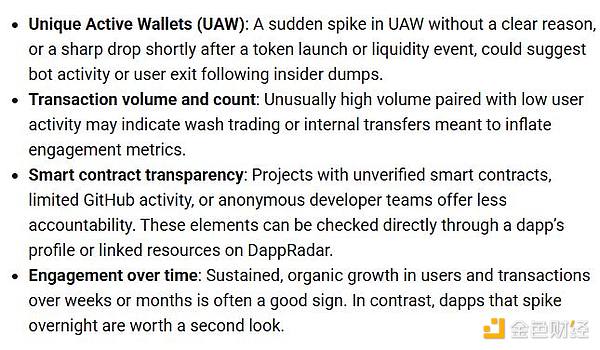

Gherghelas 表示,rug pull 的危险信号包括活跃钱包数量无明显原因地突然激增,或者交易量异常高但用户活跃度却较低。

DappRadar 分析师 Sara Gherghelas 表示,有几个危险信号可能预示着一个项目是骗局。来源:DappRadar

与此同时,未经验证的智能合约、有限的 GitHub 活动或匿名开发团队或 DApps 在一夜之间激增的项目也可能是一个危险信号。

「随着行业的成熟,不法分子使用的手段也日益精进。但用户可用的工具也越来越强大。」Gherghelas 说道。

「虽然 rug pull 行为可能永远无法完全消除,但当用户掌握正确的信息时,其影响可以大大减少。」

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。