To create a Russian USDT, the challenge lies not in "whether it can be issued," but in "what will you use as collateral."

Written by: Liu Honglin

Recently, Russia has been quite enthusiastic about stablecoins.

According to Reuters, Osman Kabaloev, Deputy Director of the Financial Policy Department of the Russian Ministry of Finance, publicly stated that Russia is considering creating an internal tool "similar to USDT." The reason is quite practical: just last month, Tether froze multiple wallet addresses of the Russian local exchange Garantex at the request of European regulators, with a total amount exceeding $27 million.

This serves as a realistic reminder: even in decentralized networks, the boundaries of regulation have long "migrated on-chain."

The on-chain environment is not a lawless land; rather, it may execute rules more efficiently. Traditional banks need to go through court processes and coordinate with multiple countries to freeze accounts. But on-chain, a single line of code or a PDF directive can freeze assets worth millions.

Thus, stablecoins do not imply freedom; they represent a new form of financial enforcement. And Russia is the first "high-privilege user" caught in this new paradigm.

As a result, Russia is once again forced to transition to Web3: "You won't let me use USDT? Then I'll issue a Russian version of a stablecoin."

But the problem arises—if you want to create a Russian USDT, the challenge is not "whether it can be issued," but "what will you use as collateral."

USDT is backed by the dollar reserves of commercial banks. If Russia truly wants to benchmark this and forcefully create a "Russian version of USDT," it must provide a complete logic of "who will custody it, what assets will it be backed by, how will currency exchange occur, and who will settle it." Otherwise, even if this coin goes live, it will merely be a "commemorative coin for on-chain rubles."

In my opinion, it would be better to adopt an abstract composite anchoring: "50% USD + 50% Trump Coin."

The dollar serves as a real support, representing a foundational credit that everyone still recognizes. Trump Coin acts as an emotional anchor, symbolizing the most typical "political symbolic asset" of this era. One is stable, the other is volatile; combined, they create stability amidst fluctuation, and fluctuation conceals stability—it's a perfect match of love and hate, a dual support of reality and fantasy.

Returning to Tether's blockade, this is the starting point of the entire event. Many people mistakenly believe that stablecoins are "technologically neutral," but in reality, these coins are issued by centralized entities registered in specific jurisdictions, which are subject to regulatory constraints and have absolute control over "freezing/unlocking" user addresses.

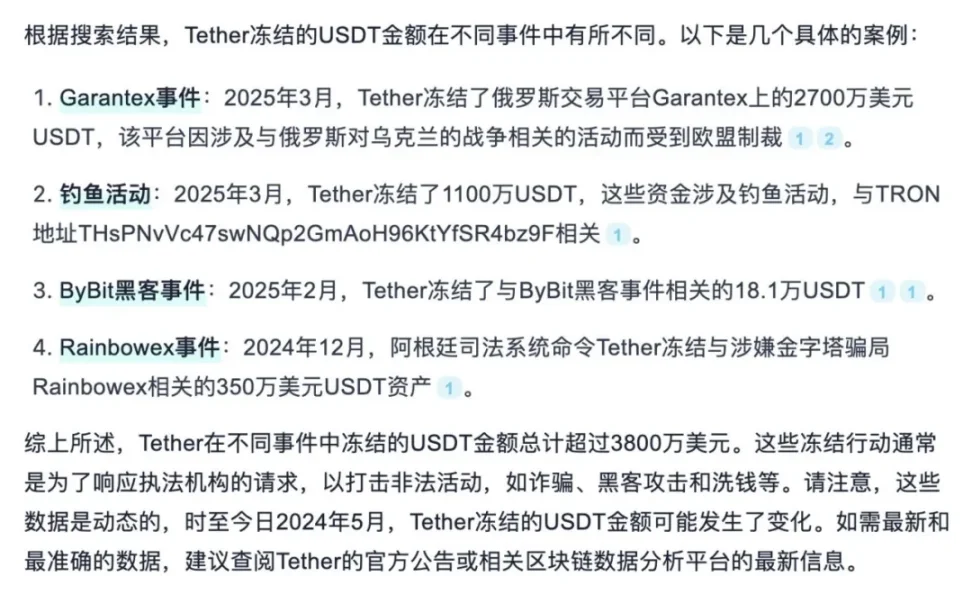

As the world's largest stablecoin issuer (with USDT's market cap exceeding $140 billion), Tether has already cooperated with global law enforcement multiple times. According to on-chain data, Tether has frozen over $1 billion worth of USDT. The reasons vary widely: hacker attacks, fraud distribution, dark web transactions, international sanction orders, court orders, and even private enforcement requests. Once Tether receives a request and determines compliance, it can freeze on-chain addresses with a single click, without even needing prior notice.

This is the true nature of on-chain stablecoins: they operate on a "decentralized" network but are essentially controlled by highly "centralized" companies. For Russia, it's like having the key to your house as your own wallet address, but the lock and access control are managed on someone else's server, allowing neighbors to change your lock at any time.

So if you want to evade sanctions, relying on USDT is ultimately a dead end. What Russia truly desires is a system where it can press the "freeze" button, a clearing capability that frees it from Western financial infrastructure—ideally, it would also allow other sanctioned countries to use it, forming a gray consensus alliance.

However, from a practical perspective, this is far from simple.

First, there are technical and operational challenges. A qualified stablecoin system must have clear anchoring assets, asset custody institutions, a transparent auditing system, and a secure and stable on-chain issuance and redemption mechanism. Although USDT is criticized for "ambiguous auditing," at least it can be redeemed for dollars. If Russia wants to establish this system, where will its underlying assets be held? In the central bank's account? Offshore? Can it accept third-party regulatory audits? Is it willing to open an on-chain fully transparent asset pool? Without resolving these issues, global users will not dare to use its coin for clearing and storing value.

Second, there is the international trust threshold. The value of stablecoins relies on reserve assets + liquidity channels + market consensus. Even if you anchor oil, natural gas, or even government bonds, to get merchants in the Middle East, Southeast Asia, and Africa to accept your coin, there must be a clear exchange logic. Once "RUB-Coin" enters a wallet, who will take it? Who will buy it back? Without these supporting systems in place, no matter how strong the narrative, it won't drive the coin's price.

The third issue is the political abstract risk. If the Russian stablecoin ultimately becomes a tool to counter financial sanctions, it may quickly be classified as a "high-risk asset" or even a "sanctioned currency"—mainstream wallets may not support it, DeFi applications may be banned, exchanges may delist it, and cross-chain bridges may blacklist it. With a set of on-chain sanctions, it could become even harder to use than the ruble itself. At that point, this stablecoin would turn into a "blockchain version of the Cuban peso," unable to gain support from real economic entities unless it circulates in gray markets and closed regions.

In contrast, there is a growing trend of "nationalization of stablecoins" globally.

Hong Kong is promoting the issuance of a Hong Kong dollar stablecoin (HKDG) by licensed institutions, Singapore's XSGD has already launched on multiple chains, and the UAE's gold-backed stablecoin has established settlement interfaces with digital central bank currencies (CBDCs). The European MiCA regulatory framework for EMT/PPT (Electronic Money Tokens and Asset Reference Tokens) is also underway, attempting to bring stablecoins under unified financial regulation in the EU.

These practices are all attempts to gradually steer the "stablecoin" market, originally dominated by companies like Tether and Circle, towards the next stage supported by national sovereignty, banking systems, and public regulation. In other words, future stablecoins will be a "digital interbank payment network" running on-chain, rather than just individuals sending coins to each other.

Russia's current move clearly aims to skip the commercial validation phase of stablecoins and jump straight to a "national version," but it has not resolved those core issues.

Can this coin succeed? Technically, it can be done; politically, it can be approved; the chain can be built, and the wallet can be written. But the key question remains: who will use it, where will it be used, and for what purpose?

If it is only used within its own system, similar to a digital ruble for domestic transfers, then it is merely a nominally different payment system. If it truly wants to be used for international trade settlement, it will face not the question of "whether it can transfer," but "who is willing to accept your coin."

Of course, to be fair, the current reality is already abstract enough. If one day you open your wallet and find a "RUSSCOIN," and it shows: backed by USD + Trump Coin + natural gas price index + BRICS consensus + some anonymous voting community sentiment score, don't laugh.

This is not the abstraction of stablecoins; this is the concreteness of this world.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。