Converge 在今年第二季度末之前上线主网。

撰文:19122212.eth,Foresight News

4 月 17 日,加密项目 Converge 由 Ethena Labs 和 Securitize 联合发布了初步技术规格与发展路线图,作为一个旨在弥合传统金融(TradFi)与 DeFi 的创新平台,Converge 以高性能、机构级安全性和用户友好性为核心,计划在今年实现主网启动并推动大规模金融应用的落地。本文将详细解析 Converge 的技术规格、路线图要点及其潜在影响。

(左为 Securitize CEO,右为 Ethena Labs CEO)

一、Ethena Labs 与金融科技公司 Securitize 联合打造

Converge 由 Ethena Labs 和金融科技公司 Securitize 联合打造,定位为高吞吐量的区块链网络,专注于支持代币化现实世界资产和 DeFi 应用。项目旨在通过技术创新和合规性设计,吸引机构资本进入加密生态,同时为零售用户提供高效的 DeFi 体验。其核心愿景是打破传统金融与加密金融之间的壁垒,促进资本流动和利率市场的全球融合。

Ethena Labs 凭借 USDe 的快速增长(市值一度超 60 亿美元,位列第三大稳定币)积累了丰富的 DeFi 经验,而 Securitize 则在资产代币化领域拥有深厚的合规与技术专长。二者的合作赋予了 Converge 独特的优势:既能满足机构对安全性和合规性的严苛要求,又能提供 DeFi 的开放性与创新性。

二、高性能 EVM 链,USDe 和 USDtb 作为 Gas 费用

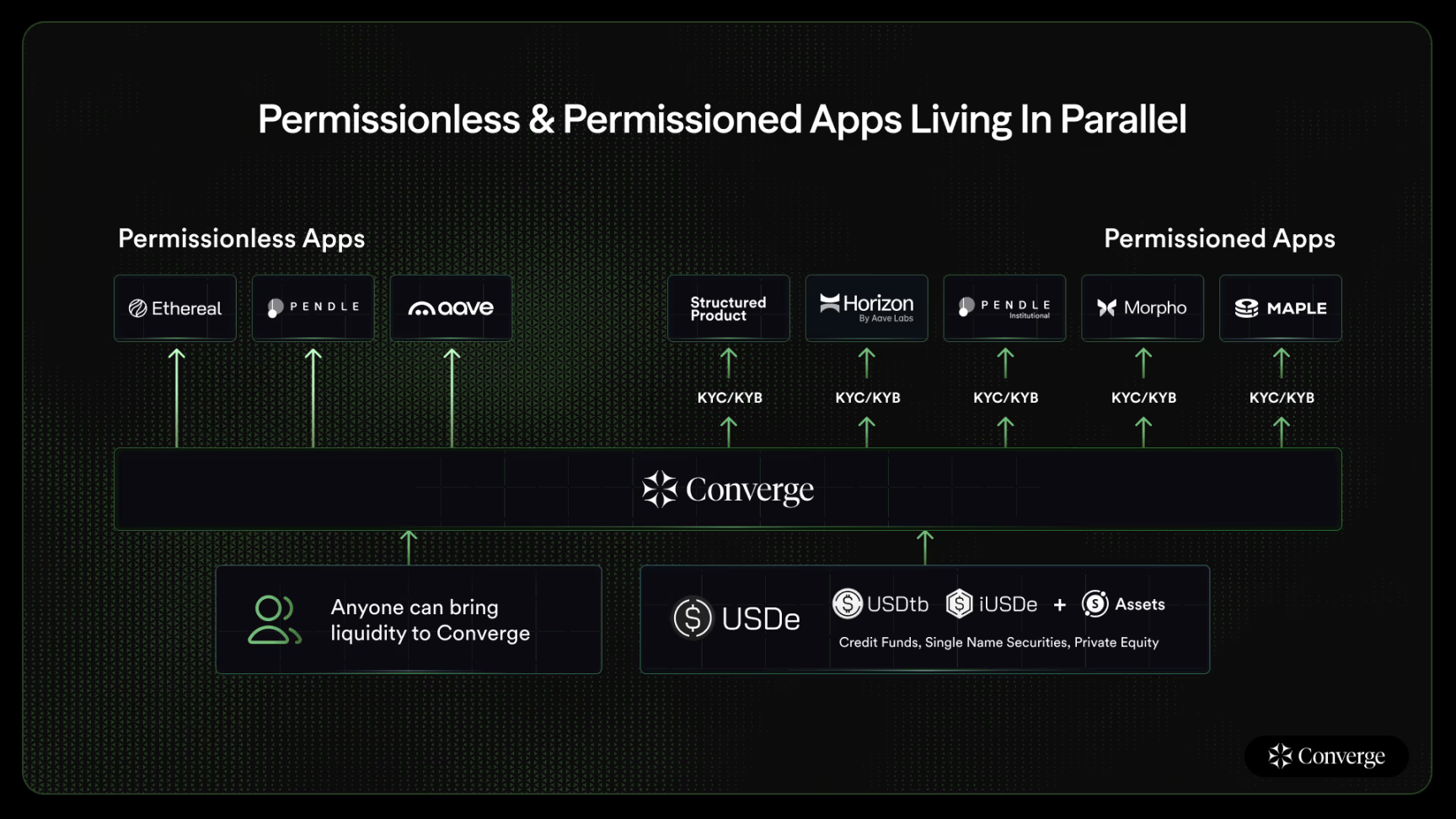

Converge 网络将同时支持无需许可的 DeFi 应用和受许可的机构级产品,实现传统金融与加密基础设施在同一条链上的融合。Converge 的技术架构围绕性能、安全性和用户体验三大支柱设计,以下是其核心技术规格的详细解读:

高性能 EVM

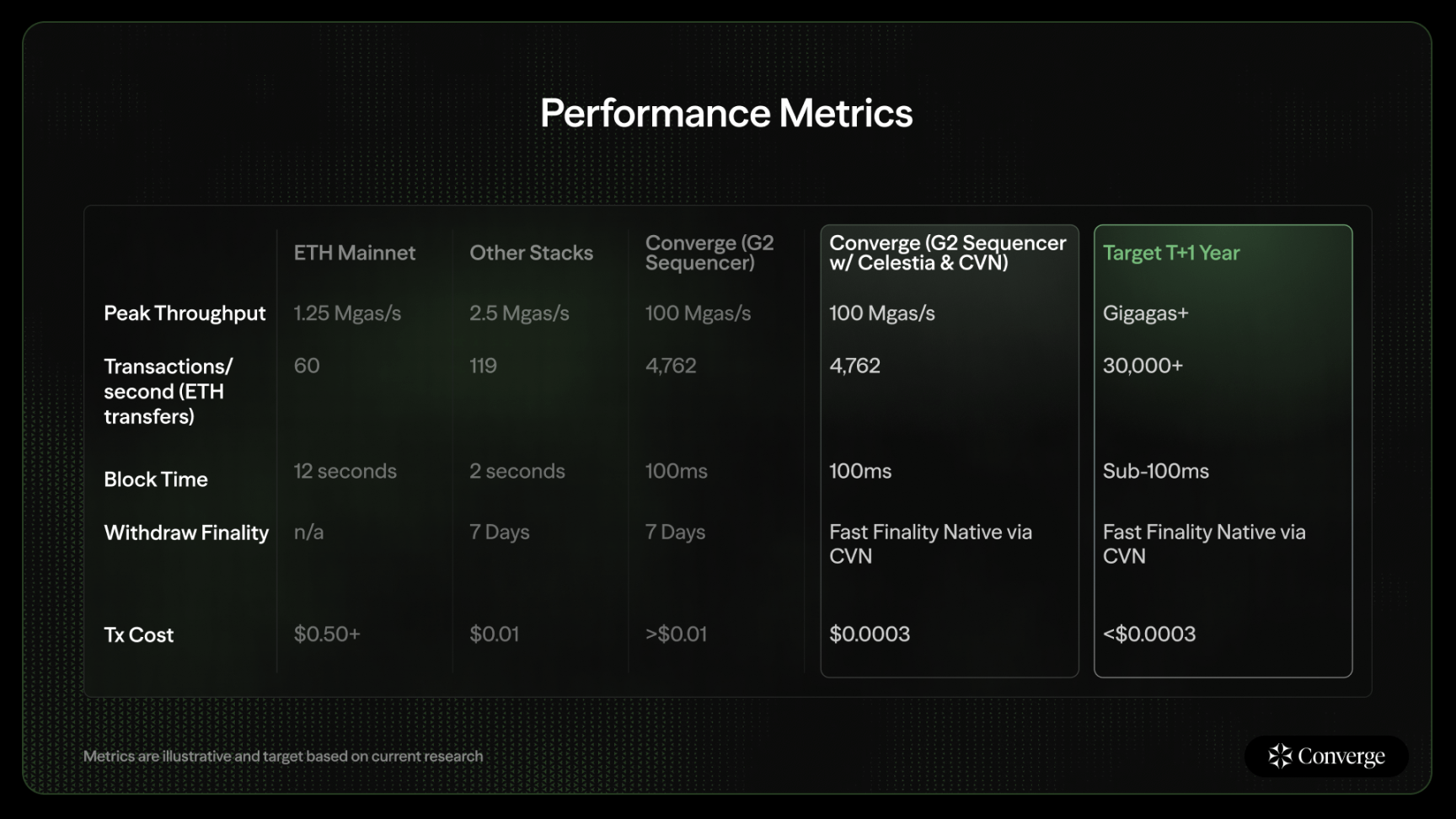

Converge 采用基于以太坊虚拟机(EVM)的架构,确保与现有 DeFi 生态的兼容性,同时通过定制化优化实现超高性能。网络启动时将实现 100 毫秒的原生区块时间,最大吞吐量可达 1 亿 gas/ 秒(Mgas/s)。路线图显示,到 2025 年第四季度,区块时间将进一步缩短至 50 毫秒,吞吐量有望达到 10 亿 gas/ 秒(Gigagas/s)。这一性能指标远超大多数现有 Layer 1 和 Layer 2 网络,足以支持大规模金融交易和复杂智能合约执行。

Arbitrum 与 Celestia 的集成

Converge 通过整合 Arbitrum 的 Rollup 技术和 Celestia 的数据可用性层,实现了低延迟和高扩展性。Arbitrum 提供高效的交易处理和智能合约执行环境,而 Celestia 则通过分离数据存储降低网络成本,确保交易费用稳定且可预测。这种模块化设计使 Converge 能够在性能与成本之间取得平衡,特别适合机构级应用。

稳定币作为 Gas 费用

为提升用户体验,Converge 选择 USDe 和 USDtb 等稳定币作为 Gas 费用代币,而非传统波动性较高的原生代币。这一设计允许用户以美元计价的单位估算和支付交易费用,避免了加密资产价格波动带来的不确定性。此外,网络支持 ERC-7702 账户抽象标准,简化钱包操作,消除 ERC-20 代币预授权和复杂 Gas 管理的痛点。

Converge 验证者网络(CVN)

Converge 引入了独特的验证者网络(CVN),通过 Ethena 的 ENA 代币进行质押以保障网络安全。CVN 采用权限验证者模型(PoS,许可集),并结合 KYC/KYB(了解你的客户 / 业务)机制,确保验证者符合合规要求。这一设计特别针对机构用户,满足其对风险管理和合规性的需求。同时,网络采用双层架构:核心网络严格控制访问权限,应用层则支持可选的无需许可接口,为开发者提供灵活性。为了参与 CVN,验证者必须质押 Ethena 的治理代币 ENA。团队表示,CVN 将在主网启动后不久上线。

定制化 G2 序列器

Converge 使用由 Conduit 定制的 G2 序列器,结合 Arbitrum 技术栈,提供高效的交易排序和确认。这一序列器是实现 100 毫秒区块时间和超高吞吐量的关键组件,确保网络在高负载场景下的稳定性。

三、未来几周上线测试网,计划 Q2 末上线主网

Converge 还公布了 2025 年路线图,清晰地勾勒了从测试网部署到主网启动的关键里程碑,具体分为以下阶段:

2025 年 Q2:测试网上线

测试网预计在未来几周内启动,为开发者提供早期接入机会,测试网络性能、智能合约部署和用户交互功能。测试网将重点验证 100 毫秒区块时间和稳定币 Gas 费用的实际表现。

2025 年 Q2:主网上线

Securitize 首席执行官 Carlos Domingo 一次采访中表示,Converge 计划在第二季度末之前上线主网。主网将支持机构和零售用户,初期重点推动 USDe 的机构级分发(如通过特殊目的载体 SPV)以及 DeFi 应用的开发。

2025 年 Q4:性能升级

到 2025 年底,Converge 计划将区块时间缩短至 50 毫秒,吞吐量提升至 1Gigagas/s,以满足代币化资产和实时金融交易的需求。此外,网络将引入更多开发者工具,如增强的账户抽象功能和智能合约模板,降低开发门槛。

四、小结

Converge 的推出恰逢传统金融与 DeFi 融合的浪潮,其高性能架构和合规性设计使其在机构采用方面具有一定优势。例如,富兰克林邓普顿 CEO 詹妮·约翰逊在 2025 年 1 月表示,清晰的监管框架将推动 TradFi 与 DeFi 的整合,而 Converge 的 KYC/KYB 机制和权限验证者模型正是对这一趋势的积极响应。

不过,Converge 也面临挑战。权限验证者模型可能引发社区对中心化风险的担忧,尽管其应用层支持无需许可接口,但核心网络的控制权仍集中在少数验证者手中。此外,高性能目标的实现依赖于 Arbitrum 和 Celestia 的稳定性,任何技术瓶颈都可能影响路线图进度。

Converge 代表兼具技术创新与现实应用潜力的机会。然而,其成功与否仍需时间检验,特别是在监管环境、技术稳定性和生态竞争等方面。未来一年,Converge 的表现无疑值得密切关注。

参考资料

1.https://www.coindesk.com/tech/2025/04/16/ethena-securitize-target-q2-mainnet-launch-for-rwa-focused-blockchain-tap-arbitrum-celestia

2.https://www.convergeonchain.xyz/blog-posts/converge-tech-specification-roadmap

3.https://coinmarketcap.com/currencies/ethena-usde/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。