币圈交易是一个长久的计划,不在于一朝一夕,所以不可操之过急,短期就算出现亏损,也没有什么可怕。只要后续方向选择正确,逝去的终将会再度回归。但是要注意把握做单时机和目前行情的动向,这样胜率才会提高。同时投资也是一个成长的过程,币先生建议各位币友们在操作当中,边操作,边学习,盈亏都要及时自我总结,加深对于风险的认知,以及的正确的心态规划,这样才能合理规避风险,成为一个合格的投资者。

4.17币圈币先生:比特币(BTC)行情分析参考

日内晚间多头情绪回暖,行情是破位走出上行,向上试探插针在85500一线承压回调,目前价格重回84000上方区域,行情再度进入盘整,多空双方再度胶着

短周期小时图上看,布林带呈收口姿态,日内币价依托30日均线调整修复,连续三日收盘站稳84000上方,但未突破上方关键位,短期震荡偏多结构。快慢线仍处于零轴下方但金叉向上,空头暂时有缩量;需关注能否突破0轴确认趋势反转。SI(4H/日线):14值53/51,中性区间,EMA:7日均线(84318)上穿30日(83935),120日线83133为短线支撑。整数关口压力,前高85500-86000附近抛压较明显,所以短期不建议在盲目追多,谨防行情承压再度回落。整体行情呈宽幅震荡姿态,且并未有破位迹象走出,所以思路维持高空低多即可。

每日更多实时单策略,在线技术学习,解套出局等可关注导师公号(币圈币先生)获取添加方式:每日前十名可获得无偿提供解套策略

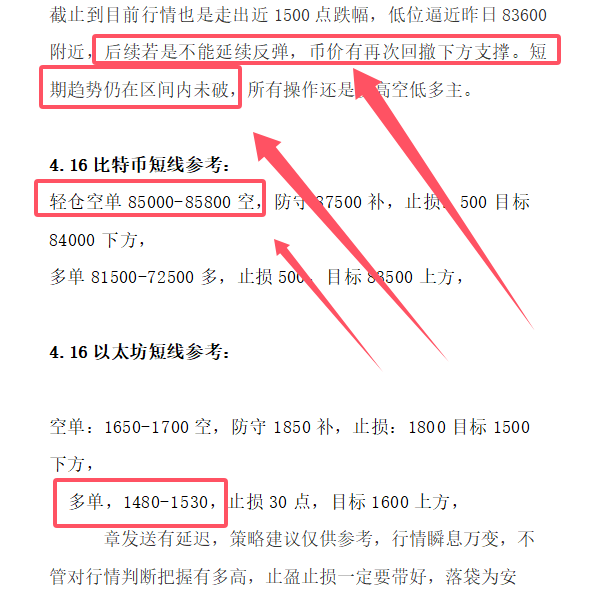

4.17比特币短线参考:

轻仓空单85000-85800空,防守87500补,止损:500目标84000下方,

多单82200-83200多,止损500,目标84000上方,

4.17以太坊短线参考:

空单:1630-1680空,防守1850补,止损:1800目标1500下方,

多单,1480-1530,止损30点,目标1600上方,

章发送有延迟,策略建议仅供参考,行情瞬息万变,不管对行情判断把握有多高,止盈止损一定要带好,落袋为安

币先生公众号:币圈币先生每日更多实时单策略,在线技术学习,解套出局等可关注导师公号(币圈币先生)获取添加方式:每日前十名可获得无偿提供解套策略

每日更多实时单可关注公众号本人名获取,可以在线盘面技术学习,解套出局等,本人对市场研究多年,研究币圈大趋势,多次在美深造学习主要分析指导BTC、ETH、DOT、LTC、FIL、EOS、BCH、ETC、等币,对于不会操作的各位币友们欢迎一起研究学习,

本文内容由币圈币先生独家原创分享,仅代表币先生独家观点,文章发送有延迟,风险自担,做单合理控制好仓位,切勿重仓或满仓操作,币先生愿各位粉丝朋友们都能实现财富自由,一起前进一起加油,时光深处,轻握一份懂得,投资中一定要学会乐观。不要让未来的你,讨厌现在的自己。我们真实地活着,但不是每一个数据揭晓后都要较真到底。过去的就让它过去,未来就让它快点到来!好好休整自己,厉兵秣马,随时准备整装待发,加油吧!

——本文由币圈币先生撰写,拒绝抄袭,尊重原创!

日内晚间多头情绪回暖,行情是破位走出上行,目前价格重回84000上方区域,向上试探插针在85500一线承压回调,行情再度进入盘整,多空双方再度胶着

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。